Brazil fertilizer imports reach record high in July amid global trade tensions

Brazil imported 4.79 million tons of fertilizers in July 2025, the largest monthly volume of the year and a historic record for the month, according to DATAGRO, citing data from the Ministry of Industry and Foreign Trade (MDIC). The figure represents a 15.6% increase from June and a 7.1% rise compared to July 2024.

From January to July, fertilizer imports totaled 24.2 million tons, up 8.8% from the same period last year and surpassing the previous record of 23.67 million tons set in 2022.

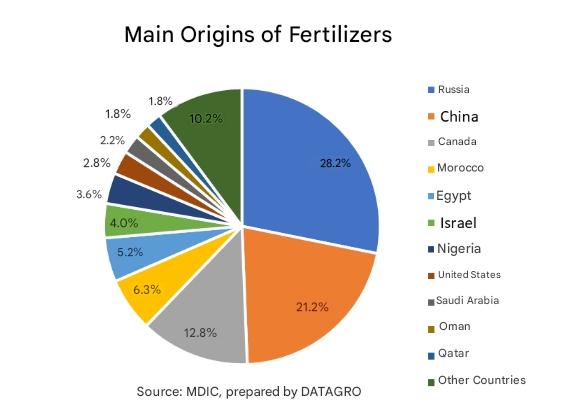

Russia remained Brazil’s main supplier, shipping 6.88 million tons, or 28.2% of the total, an increase of 18% year-on-year. China sharply expanded its share, exporting 5.14 million tons—21.2% of total imports—marking a 75.7% rise from 2024. Canada followed with 3.1 million tons, down 2.2% compared to last year.

The surge in July came against a backdrop of geopolitical uncertainty. Following June’s Middle East conflict between Israel and Iran, markets faced renewed pressure from escalating U.S. trade measures. Washington’s push to impose new tariffs on countries trading with Russia heightened concerns over supply security and drove fertilizer prices higher. India recently saw its fertilizer import tariff double to 50%.

Brazilian importers accelerated purchases to secure inputs for crop production. DATAGRO noted that early buying reflected efforts to mitigate risks of potential U.S. sanctions targeting Russian fertilizers, a key input for crops including soybeans, corn, coffee, and fruit across Latin America.

Prices strengthened across all major products. The average CIF price of NP compounds reached US$ 570.87 per ton in July, up 13.2% from June and 15.9% year-on-year. Urea rose 7% month-on-month to US$ 427.37/t, while MAP and KCl recorded increases of 5–6%. Compared to July 2024, urea is up 23%, MAP 23.8%, KCl 14.5% and ammonium sulfate 6.2%.

Mosaic, the U.S.-based fertilizer producer, warned that further trade disruptions involving leading suppliers could intensify price volatility.

Paranaguá port in Paraná was the leading entry point for fertilizer imports, handling 6.34 million tons (26.2% of the total) from January to July. Santos followed with 3.91 million tons, Rio Grande with 3.86 million, São Luís with 2.31 million, and Salvador with 1.61 million tons.

Brazil spent US$ 8.8 billion on fertilizer imports in the first seven months of the year, 16% more than in 2024. Fertilizers accounted for 5.2% of total imports, compared with 4.9% a year earlier.

DATAGRO said demand typically strengthens in the second half of the year, sustaining high prices. “Even in the face of high costs, fertilizer buying is likely to continue, since reduced productivity due to lack of crop care would have a more severe impact than the increase in expenses,” the consultancy noted.

Enjoyed this story?

Every Monday, our subscribers get their hands on a digest of the most trending agriculture news. You can join them too!

Discussion0 comments